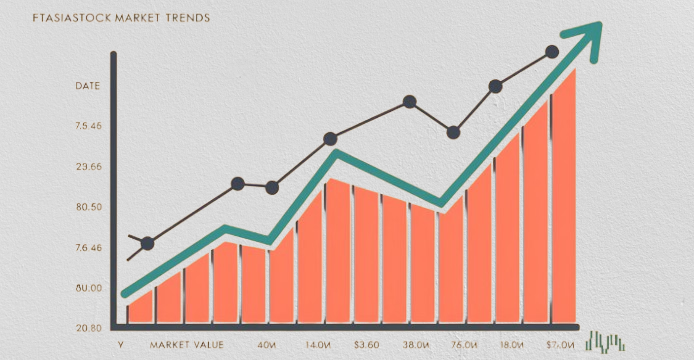

The global stock market has undergone significant transformations in recent years, with Asia emerging as a key player in driving financial innovation. In particular, FTAsiaStock market trends from FintechAsia offer valuable insights into the region’s evolving investment landscape. With advancements in financial technology (fintech), Asian stock markets have become more accessible, efficient, and data-driven than ever before. This article explores the latest FTAsiaStock market trends, providing investors with an in-depth understanding of the opportunities and challenges shaping the future of investing in Asia.

The Role of Fintech in Asia’s Stock Markets

Financial technology has revolutionized the way investors interact with stock markets in Asia. From algorithmic trading to AI-powered analytics, fintech platforms have enhanced the efficiency and transparency of financial markets. FTAsiaStock market trends from FintechAsia highlight how fintech is democratizing access to financial instruments, allowing retail investors to participate alongside institutional players.

Key Fintech Developments Impacting FTAsiaStock Market Trends

-

Digital Trading Platforms:

- The rise of user-friendly trading apps has increased retail investor participation.

- Commission-free trading and fractional ownership options have lowered entry barriers.

- FintechAsia’s platforms enable seamless trading experiences with integrated analytics tools.

-

Artificial Intelligence and Machine Learning:

- AI-driven investment tools provide predictive analytics, helping investors make informed decisions.

- Automated trading strategies optimize market entry and exit points based on real-time data.

- AI-powered chatbots offer instant financial advisory services to investors.

-

Blockchain and Tokenization:

- Blockchain technology enhances transparency and security in stock transactions.

- Tokenized assets enable fractional investments in high-value stocks and real estate.

- Smart contracts are reducing fraud and increasing transaction efficiency.

-

Robo-Advisors:

- Algorithmic investment advisors offer personalized portfolio management.

- Cost-effective wealth management solutions are now accessible to a broader audience.

- Robo-advisors adjust investment strategies based on risk tolerance and market conditions.

Emerging FTAsiaStock Market Trends from FintechAsia

1. Growth of ESG Investing in FTAsiaStock Market Trends from FintechAsia

Environmental, Social, and Governance (ESG) investing has gained traction as Asian markets shift toward sustainable finance. Investors are prioritizing companies with strong ESG credentials, influencing stock performance and market valuations. FTAsiaStock market trends from FintechAsia indicate that regulators are tightening ESG disclosure requirements, driving transparency and accountability in corporate sustainability efforts.

2. The Rise of Retail Investors in FTAsiaStock Market Trends from FintechAsia

The pandemic accelerated the entry of retail investors into the stock market, with many leveraging fintech tools to trade stocks and ETFs. Platforms like FintechAsia provide educational resources and real-time market data, empowering individuals to make strategic investment decisions. Social trading and community-driven investing have also become popular, where investors follow and replicate the trades of seasoned professionals.

3. Expansion of Tech-Driven IPOs in FTAsiaStock Market Trends from FintechAsia

Asia has become a hub for tech-driven Initial Public Offerings (IPOs), with companies in e-commerce, fintech, and artificial intelligence dominating new listings. Major stock exchanges, such as the Hong Kong Stock Exchange (HKEX) and Singapore Exchange (SGX), are attracting high-profile IPOs, making the Asian stock market more dynamic and competitive. Investors are keen on identifying high-growth tech startups that show strong revenue potential.

4. The Influence of Cryptocurrency and Digital Assets in FTAsiaStock Market Trends from FintechAsia

Cryptocurrency and digital assets are increasingly integrated into Asia’s stock markets. Fintech platforms offer hybrid investment options, allowing traders to diversify into both traditional stocks and digital assets. Regulatory developments in countries like Singapore and South Korea are shaping the future of crypto adoption within mainstream financial markets. Bitcoin, Ethereum, and stablecoins are now part of diversified portfolios among institutional and retail investors.

5. Impact of Geopolitical and Economic Factors in FTAsiaStock Market Trends from FintechAsia

Asian stock markets are influenced by global trade policies, inflation rates, and central bank decisions. The FTAsiaStock market trends from FintechAsia report highlights that China’s regulatory policies, US-China trade relations, and interest rate changes play crucial roles in market fluctuations. Investors are closely monitoring macroeconomic indicators to navigate volatility effectively. Additionally, shifts in supply chain dynamics, inflation control policies, and monetary easing in major economies like Japan and India are shaping investment opportunities.

Investment Strategies Based on FTAsiaStock Market Trends from FintechAsia

1. Diversification Across Emerging Asian Markets

Investors can mitigate risks by diversifying their portfolios across multiple Asian economies. Countries like India, Vietnam, and Indonesia are emerging as strong investment destinations, providing exposure to high-growth sectors such as technology, manufacturing, and consumer goods. Portfolio diversification ensures stability against market downturns in specific countries.

2. Leveraging Fintech Tools for Data-Driven Decisions

Using AI-powered analytics and fintech-driven insights can enhance investment decisions. Platforms like FintechAsia offer data visualization, sentiment analysis, and predictive modeling to identify market trends before they become mainstream. AI trading bots also help automate strategies based on trend predictions, optimizing returns for retail and institutional investors alike.

3. Long-Term Investing in Tech and Sustainability

Tech and sustainability-focused stocks are expected to outperform in the long run. Investing in companies that align with digital transformation and ESG principles can generate substantial returns. Tech giants in cloud computing, AI, and renewable energy sectors are becoming primary investment choices for forward-thinking investors.

4. Staying Updated on Regulatory Changes

Asian markets are rapidly evolving, with new regulations shaping investment landscapes. Keeping track of regulatory changes in fintech, digital assets, and stock market operations can help investors adapt to shifting market conditions. For example, China’s evolving regulations on tech stocks and India’s fintech policies directly impact stock valuations and investor confidence.

5. Incorporating Alternative Investments

Alternative investment vehicles such as REITs (Real Estate Investment Trusts), private equity, and hedge funds are gaining popularity in Asia. As stock markets become more volatile, investors are looking at these alternatives to hedge risks while maintaining long-term growth potential.

Conclusion

The FTAsiaStock market trends from FintechAsia reveal an exciting era of financial innovation in Asia. With fintech driving market accessibility, retail investor participation rising, and sustainability-focused investments gaining momentum, the region presents promising opportunities for investors worldwide. By leveraging fintech advancements and staying informed about market trends, investors can navigate the evolving stock market landscape effectively and optimize their investment strategies for long-term success.

For investors looking to capitalize on these trends, platforms like FintechAsia provide the tools and insights necessary to stay ahead in the ever-changing world of stock market investments. Staying informed, diversifying investments, and using cutting-edge fintech tools will be key to maximizing profits in Asia’s fast-growing financial markets.